Money Talk With Anthony

Learning and talking about Finance

Money Talk: 2024: Tax Season- I want a Million Dollar

By Professor Anthony Rivieccio MBA PFA

Look out! This is the time of the year I get pissed.

This is Tax Preparation Time, where your life for 2023- NOT 2024 , comes to a head. The documents, the planning or lack thereof

And yes, it is the lack thereof, that is pissing me off!

” Anthony, how do I get a million dollar refund” is the most popular question I get from everyone ( except my Clients) this time of the year!

But wait, it’s March of 2024–2023 is gone! Your Income is your income. Your expenses and deductions are what they are. You can not change , what may or not come — and in most cases— poor tax planning— denies yourself– your biggest tax refund possible.

I say Tax Planning , because while you can not change your 2023 situation, it is after all, March of 2024– and 9 months of tax planning– so the preparation, of next year, 2025, can only maximize your tax refund of 2024.

Tax planning is composed of several types of different strategies, all based on your life style, designed to legally lower your tax liability. And like I always like to say, the lower your liability– THE BIGGER THE REFUND!!

Some examples of Tax Planning are

* W,-4 Readjustments

* Retirement contributions

* Rental deductions

*Home & Small Business deductions

* Investment losses

*Medical expenses

*Home Mortgage

* Gifts to charity

*Job expenses

There are over 500 deductions and based on lifestyle, could lead to over 125 different strategies.

The best to help you with this would be a tax and/ or financial professional. Yes you could do it yourself, but then you’ll have my job ( do you also have 33 years experience  ) but trust me, you don’t want to, unless you want to live with aspirin for the headaches .

) but trust me, you don’t want to, unless you want to live with aspirin for the headaches .

The process during those 9 months should be a series of conversations with your professional so you can discuss your life style events while designing a sequence of strategies all designed and implemented — Now!. The earlier, the better!. Why?

So Next March, 2025, you already know your ready with your 2024 taxes and expecting a larger refund

NOT asking, in March of 2024, ” how to I lower my liability for 2023″. It is not Tax planning time, it is NOW, Tax Preparation time.

Want a million dollar refund? Plan it right! Tax Planning,!.

Professor Anthony Rivieccio, MBA PFA, is the founder of The Financial Advisors Group, celebrating its 25th year as a full service investment planning & management firm . Anthony is also owner of Rivieccio Financial Advisors, a virtual only financial planning & advisory firm, opened in 2021.

Mr. Rivieccio pens a financial article called “Money Talk” along with ” Financial Focus”. Mr. Rivieccio, a recognized financial expert since 1986, has been featured by many national and local media including: Kiplinger’s Personal Finance, The New York Post, News 12 The Bronx, Bloomberg News Radio, BronxNet Television, the Norwood News, The West Side Manhattan Gazette, Labor Press Magazine, Financial Planning Magazine, WINS 1010 Radio, The Co-Op City News, The New York Parrot, The Bronx News, thisisthebronX.info , The Bronx Chronicle & The Parkchester Times.

Anthony is also currently an Adjunct Professor of Business, Finance & Accounting for both, City University of New York & Monroe College, a Private University.

Ask The Professor is your new Personal Finance Do It Yourself community found in Facebook Groups.

https://facebook.com/groups/

For financial assistance, Anthony can be reached at (347) 575-5045. Have Facebook? My email is a_rivieccio@yahoo.com My personal page is www.facebook.com/

Money Talk: 2024: Simple Taxes Free TurboTax - Free IRS? By Professor Anthony Rivieccio MBA PFA

By Professor Anthony Rivieccio MBA PFA

So, in” simple “terms, why does one use TurboTax?

* Maybe it’s simple and I can do it myself?

* The commercial says” all I have to do is click” , and I’m done with itin 20 minutes

* I can do my taxes in the convenience of my own home

* It’s cheap

Now, all of those reasons are valid and true — and let’s not forget the word, ” simple”

” Simple ” or what we call ” no deductions or credits ” taxes should only take 20 minutes to fill out your general information and areas of income . Yep , just click, do it in the bathroom and off you go . That’s the TurboTax ” Simple ” way

And now, the IRS has a “simple” model too, called Direct File.

Since May 2023, the IRS has been developing its own tax filing software that can be used for free, and this filing season. The Direct File pilot program is designed to allow certain people the ability to file electronically – much like the commercial options from TurboTax or H&R Block.

The program can accept basic tax forms. Those include a W-2 from an employer, a 1099-G for those receiving unemployment benefits, Form SSA-1099 for those getting Social Security payments, and up to $1,500 in interest income or U.S. bond obligations.

Sounds great right? Ok, where do I put my Small Business or Investment Income? Where do I put my Medical Expenses, Job Expenses, Small Business or Rental Expense Deductions?

Oh oh

Direct File can’t process 1099-K or 1099-NEC returns, meaning it can’t be used for any income from payment apps, online marketplaces, or payment cards, nor for any money coming in from “gig economy” jobs, such as delivery apps or Uber.

It also can’t take in 1099-MISC forms, which cover income from rent, prizes, and awards; 1099-Rs, which involve pension and retirement account distributions; and any allocated or unreported tips. The system doesn’t support any alimony that must be reported as income.

People using Direct File must choose the standard deduction; itemized deductions are not supported. Those who might consider itemizing include those who spent more than 7.5 percent of their income on health care; those who donate heavily to charity; and those who pay a large amount of property taxes or mortgage interest.

And guess what? TurboTax , is the same way. They both do ” Simple ” returns, which have been briefly defined by The Government as 37% of Filers.

What about the other 63%?. Well, I guess it’s not so simple.

The IRS Direct File system is a small move toward a broader potential shift in the American tax system. Some congressional Democrats have pushed for an overhaul that would do away with filing altogether and have the IRS prepare a tax assessment to which each citizen could add amendments. But that kind of overhaul faces stiff opposition.

So if your part of the 63%? My own opinion, dont do it yourself. You don’t know the time consuming work involved . I would definitely suggest to see a Tax Advisor, not just for the preparation but also for the ” Tax Planning” to both fine-tune and explore other deductible areas .

For the 37% who say, ” I have no deductions, where do I sign and when am I going to get my refund”. Let me make a suggestion: Why don’t you learn Tax Planning? There are over 500 tax advantaged areas.

No, you don’t want to!. You just want to process your taxes for free , get your low refund and you could be debating which system you should use?.

Well, considering the IRS Direct File system has already been making reported mistakes and with TurboTax used in succussion years of misleading advertising creating millions in government fines, that’s like asking me, which one is more cute: Dracula or Frankenstein ?( although I must admit I did have a crush on Ms Frankenstein when I was a kid  ).

).

Get Professional Help? Your Taxes are not Pop Tarts!

Professor Anthony Rivieccio, MBA PFA, is the founder of The Financial Advisors Group, celebrating its 25th year as a full service investment planning & management firm . Anthony is also owner of Rivieccio Financial Advisors, a virtual only financial planning & advisory firm, opened in 2021.

Mr. Rivieccio pens a financial article called “Money Talk” along with ” Financial Focus”. Mr. Rivieccio, a recognized financial expert since 1986, has been featured by many national and local media including: Kiplinger’s Personal Finance, The New York Post, News 12 The Bronx, Bloomberg News Radio, BronxNet Television, the Norwood News, The West Side Manhattan Gazette, Labor Press Magazine, Financial Planning Magazine, WINS 1010 Radio, The Co-Op City News, The New York Parrot, The Bronx News, thisisthebronX.info , The Bronx Chronicle & The Parkchester Times.

Anthony is also currently an Adjunct Professor of Business, Finance & Accounting for both, City University of New York & Monroe College, a Private University.

Ask The Professor is your new Personal Finance Do It Yourself community found in Facebook Groups.

https://facebook.com/groups/

For financial assistance, Anthony can be reached at (347) 575-5045. Have Facebook? My email is a_rivieccio@yahoo.com My personal page is www.facebook.com/

Money Talk: 2024: Tax Season- Medical Expenses

By Professor Anthony Rivieccio MBA PFA

Medical Expenses is one, of 500, tax advantaged ways to lower your tax liability. The lower your tax liability, the odds are bigger , your tax refund is bigger.

When I meet with Clients to discuss this area I advise them to get a pen and paper. I also tell them to close their eyes. Visualize, a doctor looking at your scalp at the top of your head——going Down!.

Your head, your eyes, your nose, your teeth, your arms, your legs.

Did you have to get your head checked? Your ears looked at? By glasses? Prescription Drugs? That is the ABC version!. Yes, get ready here we go!.

According to the IRS, Medical care expenses include payments for the diagnosis, cure, mitigation, treatment, or prevention of disease, or payments for treatments affecting any structure or function of the body.

Deductible medical expenses may include but aren’t limited to the following:

- Amounts paid of fees to doctors, dentists, surgeons, chiropractors, psychiatrists, psychologists, and nontraditional medical practitioners.

- Amounts paid for inpatient hospital care or residential nursing home care, if the availability of medical care is the principal reason for being in the nursing home, including the cost of meals and lodging charged by the hospital or nursing home. If the availability of medical care isn’t the principal reason for residence in the nursing home, the deduction is limited to that part of the cost that’s for medical care.

- Amounts paid for acupuncture treatments.

- Amounts paid for inpatient treatment at a center for alcohol or drug addiction; amounts paid for participation in a smoking-cessation program and for prescription drugs to alleviate nicotine withdrawal.

- Amounts paid to participate in a weight-loss program for a specific disease or diseases, including obesity, diagnosed by a physician.

- In limited situations, amount paid for membership to a health club primarily for the purpose of preventing or alleviating obesity.

- Amounts paid for insulin and prescription medicines or drugs.

- Amounts paid made for admission and transportation to a medical conference relating to a chronic illness of you, your spouse, or your dependent (if the costs are primarily for and essential to necessary medical care). However, you may not deduct the costs for meals and lodging while attending the medical conference.

- Amounts paid for false teeth, reading or prescription eyeglasses, contact lenses, hearing aids, a guide dog or other service animal to assist a visually impaired or hearing disabled person, or a person with other physical disabilities, crutches, and wheelchairs.

- Amounts paid for transportation primarily for and essential to medical care that qualify for the medical expense deduction. Amounts paid for transportation include your out-of-pocket expenses for your personal car such as gas and oil, or the standard mileage rate for medical expenses, plus the cost of tolls and parking; taxi, bus, or train fare; and ambulance costs.

- Amounts paid for insurance premiums to cover medical care or qualified long-term care.

- Certain costs related to nutrition, wellness, and general health are considered medical expenses.

Professor Anthony Rivieccio, MBA PFA, is the founder of The Financial Advisors Group, celebrating its 25th year as a full service investment planning & management firm . Anthony is also owner of Rivieccio Financial Advisors, a virtual only financial planning & advisory firm, opened in 2021.

Mr. Rivieccio pens a financial article called “Money Talk” along with ” Financial Focus”. Mr. Rivieccio, a recognized financial expert since 1986, has been featured by many national and local media including: Kiplinger’s Personal Finance, The New York Post, News 12 The Bronx, Bloomberg News Radio, BronxNet Television, the Norwood News, The West Side Manhattan Gazette, Labor Press Magazine, Financial Planning Magazine, WINS 1010 Radio, The Co-Op City News, The New York Parrot, The Bronx News, thisisthebronX.info , The Bronx Chronicle & The Parkchester Times.

Anthony is also currently an Adjunct Professor of Business, Finance & Accounting for both, City University of New York & Monroe College, a Private University.

Ask The Professor is your new Personal Finance Do It Yourself community found in Facebook Groups.

https://facebook.com/groups/

For financial assistance, Anthony can be reached at (347) 575-5045. Have Facebook? My email is a_rivieccio@yahoo.com My personal page is www.facebook.com/

Money Talk: 2024; Ready for a BIGGER Income Tax Refund?

By Professor Anthony Rivieccio MBA PFA

Holiday time is over!

The time for spending has finished! It is time to pay those holiday bills.

Maybe you’re thinking your income tax refund will help? In some ways, it can.

After all, who isn’t going to need a higher tax refund? Okay, cool. Did you tax plan? Tax plan? What’s that?

What is tax planning? No, it is not tax preparation. That can take anywhere from 15 minutes to six hours, based on the preparation of the worksheets and schedules. Tax planning is much more comprehensive.

I like to say that the difference between tax preparation and planning is like baking a cake. Tax planning is getting all the ingredients or receipts and put them in their proper places, while tax preparation goes from mixing all the ingredients to popping the cake mix into the oven and letting it bake. Like anyone who bakes or cooks knows, getting all the “right” ingredients take time but the cake will surely taste better!

Do you know which tax rates and breaks were made permanent in the last 12 months? Did you keep copies of your receipts regarding medical expenses or gifts to charity? Did you get robbed and get a police report? Do you own a home business in your home? Do you know how much mileage you use to and from work?

What does this all mean? Tax planning is as essential as ever.

Tax planning, in its purest form, should provide an overview of key tax provisions that you need to be aware of and offer you a wide variety of strategies for minimizing your taxes. But there isn’t enough space to touch on all of the available tax-saving opportunities.

Now, is the time, to sit down with a tax or financial advisor and let him take you through a “tax overview” of your life and lifestyle habits. After a thorough examination, he or she should be able to prescribe a “checklist of deduction and credits” you could be eligible for, or more importantly, should be incorporating into your lifestyle already — you’re just not receiving the tax benefit. Remember, we get taxed on net income, not gross income!

What’s the difference? The subtraction of tax deductions and credits brings you to your net income — on which our taxes are assessed.

The lower your net income, the lower your tax rate. In theory, the lower your tax rate, the higher your tax refund will be. Want to pay your holiday bills with your tax refund? Forget tax preparation; learn tax planning now!

Professor Anthony Rivieccio, MBA PFA, is the founder of The Financial Advisors Group, celebrating its 25th year as a full service investment planning & management firm . Anthony is also owner of Rivieccio Financial Advisors, a virtual only financial planning & advisory firm, opened in 2021.

Mr. Rivieccio pens a financial article called “Money Talk” along with ” Financial Focus”. Mr. Rivieccio, a recognized financial expert since 1986, has been featured by many national and local media including: Kiplinger’s Personal Finance, The New York Post, News 12 The Bronx, Bloomberg News Radio, BronxNet Television, the Norwood News, The West Side Manhattan Gazette, Labor Press Magazine, Financial Planning Magazine, WINS 1010 Radio, The Co-Op City News, The New York Parrot, The Bronx News, thisisthebronX.info , The Bronx Chronicle & The Parkchester Times.

Anthony is also currently an Adjunct Professor of Business, Finance & Accounting for both, City University of New York & Monroe College, a Private University.

Ask The Professor is your new Personal Finance Do It Yourself community found in Facebook Groups.

https://facebook.com/groups/

For financial assistance, Anthony can be reached at (347) 575-5045. Have Facebook? My email is a_rivieccio@yahoo.com My personal page is www.facebook.com/

Get Your Tax Questions answered for FREE at " Ask The Tax Professor" FB Group

Rivieccio Financial Advisors, a virtual financial advisory firm & a strategic partner with The Financial Advisors Group, are providing A Live Income Tax Library at our Facebook Group page, Ask The Tax Professor

The FREE Group page, provides; Real Time Tax News & Information, Graphs, Case Studies, Articles, Videos, Calculators, ebooks, Webinars and LIVE TAX Administrators

Professor Anthony Rivieccio MBA PFA, founder of Rivieccio Financial Advisors says “ we want to teach anyone and everyone who wants to learn the tenats of Income tax planning so they can make their tax life better and achieve a higher tax refund”.

Just go to The Facebook Group Search Engine and type in ” Ask The Tax Professor” or just click on the link below

Money Talk: 2024; Ready for Taxes? Retirement? Ask The Professor, for FREE

By Professor Anthony Rivieccio MBA PFA

When I was preparing for my semi retirement 2 years ago, many of my College Students were legitimately concerned. Not for my health or welfare- but how they can get their financial questions answered for Free.

Many people take Personal Finance continuing education for many reasons but in short it comes down to two:

They are either preparing to take the CFP ( Certified Financial Planner) examination to start or enhance a career or they want to re- analyze their own financial situation through classes and education.

So, whether I am teaching ” Retirement, Investment , Estate or Income Tax” planning, some students are ready to zip in the Free Questions. And of course , I try to work their questions into the course material so they can figure out both; but that doesn’t stop them from making appointments with me after hours, for more FREE Questions! .

.

So being a Social media user on Facebook , I created 2 Free Personal Finance Groups, under the guise of ” Ask The Financial Professor” and ” Ask The Tax Professor”.

The Ask The Financial Professor FB Group age will cover areas from; budgeting, debt, savings, investment retirement and estate planning concerns while ” Ask The Tax Professor” is niche specific on Income Taxes.

On a daily / weekly/ monthly basis , in both FB Groups, I try to create an environment for FREE:

* Financial morning information, news & analysis- before – and after – the financial markets open

* Financial Games & Quizzes- to test your knowledge

* Freebies- from Guides to Graphs to ebooks

* How to videos- 5 minutes to learn how to solve a financial problem

* Our Financial Focus Fridays- where we showcase our biweekly ” Financial Focus” articles & ” Financial Focus University TV show

* Our Events section which has LIVE; webinars, classes & courses ( some paid)

* And our weekly posting ” Ask The Question” series

While both FB group rooms are pretty private and small ( less than 300) I think it is the perfect mix of; Students, Clients , and individuals- serious- about having Financial Planning in their lives and want help- whether it is from a live professional – or learn to do it yourself!. I believe our FB groups actually provide, both

So, if your reading this article then I presume your interested in Financial Planning. Take this as an invitation to come join us, for FREE. Just go to the FB links below or go to FB group search and type in the name of the group

* Ask The Financial Professor

https://m.facebook.com/groups/

* Ask The Tax Professor

https://m.facebook.com/groups/

In our opinion, one of the keys to financial wealth is by lowering your income taxes. Think about it!. Would you rather achieve a 10% return on investment or lower your taxes by 40%, if you could only choose one?.

So, join us, below!.You might be surprised whom you’ll meet, the information supplied, the events held, our ” how to” video answers and how fast I answer your Financial Question. As our column suggests, get ” Financially Focused”.

Professor Anthony Rivieccio, MBA PFA, is the founder of The Financial Advisors Group, celebrating its 25th year as a full service investment planning & management firm . Anthony is also owner of Rivieccio Financial Advisors, a virtual only financial planning & advisory firm, opened in 2021.

Mr. Rivieccio pens a financial article called “Money Talk” along with ” Financial Focus”. Mr. Rivieccio, a recognized financial expert since 1986, has been featured by many national and local media including: Kiplinger’s Personal Finance, The New York Post, News 12 The Bronx, Bloomberg News Radio, BronxNet Television, the Norwood News, The West Side Manhattan Gazette, Labor Press Magazine, Financial Planning Magazine, WINS 1010 Radio, The Co-Op City News, The New York Parrot, The Bronx News, thisisthebronX.info , The Bronx Chronicle & The Parkchester Times.

Anthony is also currently an Adjunct Professor of Business, Finance & Accounting for both, City University of New York & Monroe College, a Private University.

Ask The Professor is your new Personal Finance Do It Yourself community found in Facebook Groups.

https://facebook.com/groups/

For financial assistance, Anthony can be reached at (347) 575-5045. Have Facebook? My email is a_rivieccio@yahoo.com My personal page is www.facebook.com/

Money Talk: So, the pundits say we're in a recession!? Are we? Are you?

Money Talk: 25 Years : From Self Employment to Retirement?

Money Talk: What kind of TV do you watch

Money Talk: What kind of TV do you watch?

By Professor Anthony Rivieccio MBA PFA

Many years ago , I wrote an article discussing how “streaming” was going to be the new way to watch TV, whether it is cable or broadcasting.

It happened so fast!

According to recent reports, Cable TV represented just 30 percent of all TV use, and broadcast networks represented 20.8 percent of all TV use. Streaming was the most popular way people watched TV, with 37.7 percent of TV viewing in May 2023.

Here Are The Top 10 Streaming Services:

YouTube: 8.8 percent

Netflix: 8.2 percent

Hulu: 3.5 percent

Prime Video: 3.2 percent

Disney+: 2 percent

Tubi: 1.4 percent

Max: 1.4 percent

Peacock: 1.2 percent

Paramount+: 1 percent

Roku Channel: 1.1 percent

Pluto TV: 0.9 percent

The next and younger generation, wants their TV: portable and cheap.

Well, portable, we see the majority of Americans should be there soon. As far as cheap; I think that’s a matter of opinion.

Based on simple inflation: the 1993 Cable Bill was $25 a month and should be worth $45 today. Is your cable bill $45 today? No? Exactly, and that’s just one reason

Secondly, you’ll see above, some are cheap, some are even, FREE!

But lastly, before you cut the cord. Remember this ( as I said several years ago ) in my opinion the maximizing of price and value will come in both: understanding what you consume & how you get that content

Using myself as an example, because of my work lifestyle, I consume

* Morning/ Afternoon- Business news

* Late evening- Sports/ movies

I do not watch TV in between.

So for my business news, there are many platforms where I can get 24 hour business news, live and FREE , by using, for example, Pluto TV and tap into their ” News section” . I keep it on all during business hours because of the nature of the work we do. If I want to get even cuter, CNBC, the cable news channel, has LIVE streaming, right on their website page. Just go to CNBC.com and bang

In the late evening, I like to relax and watch TV for 2 hours to unwind. Maybe a Sports event or a movie ?

If it’s Sports, it will not be live, only because of my hours, but, I can go right to You Tube , which is FREE , to watch delayed nights of : Baseball, football, basketball, etc.

As a Boxing & Wrestling Fan, their is more than enough content to satisfy that consumption.

If it’s a Movie, I go right to Tubi , again a FREE platform , to watch a movie. They do have a large selection . Pluto TV also has a great selection of on demand shows, from 1952- to 2022.

Notice I keep saying Free, right. But I’ll be frank, by doing this, then buying stand alone platform channels ( for example HBO) at $5-$10 a month, I think one can save hundreds or even thousands of dollars per year.

And of course, CBS, FOX, NBC & ABC are still free right!?

So, do you cut the cord? Are you ready for ” streaming TV”!?.

Money Talk: Less Money? Taxes going up? No, It's called Inflation!

By Professor Anthony Rivieccio MBA PFA

Hello, Higher Prices! If you were born before the 1970s you actually recognize that prices are going up but your still inhaling and exhaling because compared to the early 1980s ,20% inflation, we can handle this  .

.

For people born after 1980, I think they are in ” shock world”

Yes , since the mid 1980s, 40 years, 5 decades ago, 2-3% inflation was normal. Wages were always over inflation so consumer spending was always humming along.

Oh the good olde days!

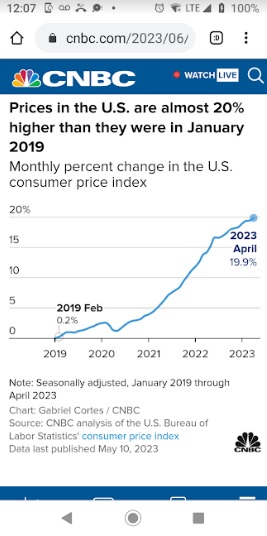

Fast forward to today, average inflation , now, is hovering at 6-7% Yes , prices in some goods and services have tripled – and that’s before taking the corporate greed into account.

Furthermore, it didn’t take 5 decades to go up! How about 5 years!

And while inflation effects everyone, most dangerously, it hurts low income people the hardest .

By most measures, lowest-paid workers spend more of their income on necessities such as food, rent and gas, categories that also experienced higher-than-average inflation spikes.

And when inflation goes up and overtakes personal income and spending — real wages go down.

And when inflation goes up, interest rates go up. Is that good? That depends? Have credit card debt? College debt? Mortgage? The price just went up

I took a recent screenshot from CNBC to highlight the rapid pace of inflation, monthly, since 2019. Before then , monthly inflation was 0.2-0.3% on average

The moral of the story? Well , if you were born before 1980, you know the answer but you might have to teach the ” youngtimers” of a concept they might have ever heard of before: Budgeting

Contact

Any questions please free to contact me

- arivieccio3015@gmail.com

- 347-575-5045