Check Here First For LOcal News

Veterans Post

Rust on the surgical instruments?

BYLINE: By Freddy Groves

Good grief. Just how many deficiencies can one Department of Veterans Affairs facility have? A recent VA Office of Inspector General report itemized just how many when they inspected one particular hospital.

Starting at the door of this facility, there was the small problem of signs leading to the emergency room, which the facility no longer had. Other outdoor signs were so faded they were difficult to read. Interior navigational signs were inaccurate. Add to that, there was no place to sit once one got in the door, only in the vending machine area down the hall, described as “dirty and disorganized.”

Two employees were designated as toxic exposure navigators, staff meant to give the screenings to veterans. It was determined that over 450 screenings had not been done.

One disturbing deficiency at this particular facility concerned the delays in notifying patients of abnormal test results. The VAOIG had dinged this facility a few years ago for that same problem and saw there had been no improvement. The plan: Develop a process to ensure prompt communication of test results. Target date for that: July 31, 2025.

And then we have the areas where biohazardous materials were stored, yet there was no sink nor hand sanitizer, no warning signs about the “potentially infectious material” — along with cracks in the floor, holes in the walls, dust on the bed rails and handbooks that were years out of date.

The biggest problem unearthed by the VAOIG concerned the continued improper sterilizing processing of reusable medical equipment, something the VAOIG had reported on the previous year. The facility claimed that improvements had been made, yet during the inspection itself, even more problems with the sterilizing process came to light — including surgical instruments with rust.

It’s gut-wrenching to read VAOIG reports like this and know that some veterans have no choice but to seek their health care at facilities with serious deficiencies like those at this VA facility.

I hope the new VA secretary reads these reports when they cross his desk.

80 Years of Changing Lives: Community Through the Lens

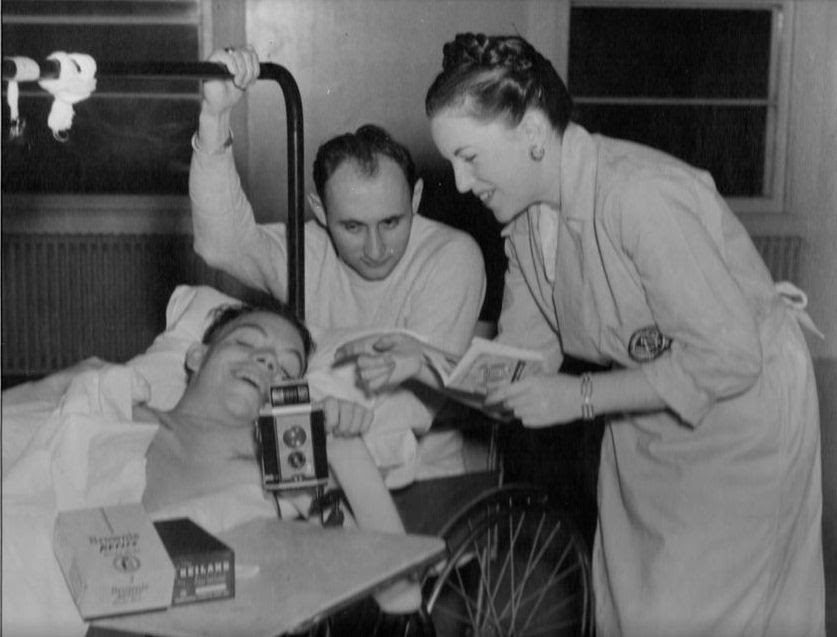

Last month, of course, we want to celebrate our veterans. These four images continue the conversation between the decades. The first photo, from 1946, shows a group of Navy servicemen returning to New York City, the end of World War II mere weeks before. The second is from 2019 shows another group of veterans, including our board member and teaching artist Alberto Vasari (second from left), this time with cameras in hand, looking back at us and ready to tell their story.

The last two photographs cover the same two periods, the late 1940s and late 2010s, both made in the same location. Both were taken at the VA hospital at St. Albans in Queens, where we have provided programs since the field of rehabilitative photography was pioneered there by Josephine Herrick and Dr. Howard Rusk in the mid-1940s.

Stefanik Passes Bipartisan Bill Named After North Country Veteran and Family to Enhance Veterans’ Access to VA Benefits

WASHINGTON, D.C. – Congresswoman Elise Stefanik, Chairwoman of House Republican Leadership, delivered the following remarks ahead of her legislation, the Ernest Peltz Accrued Veterans Benefits Act, passing the House of Representatives.

Remarks as prepared for delivery:

“Thank you, Madam Speaker, and thank you to Chairman Bost. I rise today in support of my legislation, the Ernest Peltz Accrued Veterans Benefits Act H.R. 3123. I also want to thank Ranking Member Takano for his comments and support.

I represented the Peltz family for well over a decade, and that included Ernest Peltz, a World War II veteran and American hero, who died a few years ago between Christmas and New Year’s. At that time, I heard from his son, Charles Peltz, who found himself caught in a maze of bureaucratic VA red tape. Instead of being able to focus on honoring the life and service of his father, the Peltz family was forced to contend with a system that failed the very veteran it was designed to serve.

Hero Ernest Peltz did everything right: He served admirably and honorably in our military. He continued a lifetime of public service. He applied for his accrued veterans pension benefit, and the Department of Veterans Affairs approved it while he was still alive. Yet due to a processing error, the VA did not deposit the funds until after Mr. Peltz’s passing. In an even more troubling turn, the VA then clawed those funds back—even though Ernest Peltz was alive at the time his benefit was approved and fully earned.

As a result, Ernest’s family was left to shoulder the financial burden of his father’s care on their own, compounding grief with stress, uncertainty, and frustration. In short, the Peltz family was penalized for the VA’s mistakes. This is unacceptable.

That’s why I first introduced the Ernest Peltz Accrued Veterans Benefits Act two Congresses ago. For years, I’ve worked closely with the Peltz family, veterans service organizations, the Department of Veterans Affairs, and my colleagues on both sides of the aisle—like Congressman Ro Khanna—to craft legislation to correct this moral wrong. My bill eliminates the burden on a veteran’s surviving family by ensuring that the veteran is entitled to receive their pre-approved pension benefits within the month that death occurs.

I represent New York’s 21st Congressional District—serving the largest number of veterans in any district in NY State. That’s why I’m proud to take action to make sure no family mourning the loss of a beloved veteran has to deal with VA red tape and bureaucratic mistakes.

This commonsense bipartisan legislation honors the legacy of World War II veteran Ernest Peltz and takes a critical step toward improving the VA’s effectiveness and accountability.

In passing my legislation, Congress can rightfully honor veterans for their service and guarantee their families the dignity and respect they have earned.

I want to particularly thank Ernest’s son, Charles Peltz, who is a friend and tireless advocate of this legislation. I urge a “yes” vote on my bill and yield the floor.”

BOROUGH PRESIDENT GIBSON AND VETERANS ADVISORY COUNCIL HOSTED A VETERANS APPRECIATION MONTH KICK-OFF CEREMONY TO HONOR BRONX VETERANS

Bronx, NY—On Wednesday, October 29, 2025, Bronx Borough President Vanessa L. Gibson, in partnership with the Bronx Borough President’s Veterans Advisory Council, NYC Department of Veterans’ Services, Worldwide Veterans and Family Services, and the Sam Young American Legion Post 620, hosted a Veterans Appreciation Month Kickoff to honor and celebrate Bronx veterans from all five branches of the U.S. Armed Forces. The event marked the official start of a month-long series of programs celebrating Veterans Appreciation Month and honoring the courage, service, and sacrifice of those who have defended our nation.

The ceremony featured a full program of acknowledgments and remarks from veteran community leaders and public officials. Commander Bobby Oviedo served as the program’s emcee, opening with the Pledge of Allegiance and a performance of the National Anthem by Belinda Barnes. Speakers included James Hendon, Commissioner of the Department of Veterans Services, who highlighted city initiatives supporting veterans and their families, and Juan Ernest Parra, Chair of the Veterans Committee for Bronx Community Board 5, who delivered the keynote address emphasizing leadership, resilience, and community impact.

Borough President Gibson also addressed the ceremony`s attendees, highlighting the importance of advocacy, resources, and partnership efforts in supporting veterans and their families. During the event, seven honorees were recognized that included: Ms. Donee’ Smalls of the US Army; Raoul Anthony Laboy of the US Air Force; Daniel Guzman of the US Marine Corps; Tony Salimbene of the US Coast Guard; Gene Anthony Edward of the US Navy, Robert J. Treacy of the US Navy and Juan Ernest Parra, Chair of the Veterans Committee for Bronx Community Board 5.

“The Bronx is home to many heroes who have proudly served our nation, and it is our duty to honor them and make sure their contributions are never forgotten,” said Bronx Borough President Vanessa L. Gibson. “This month and every month, we recognize the courage, dedication, and leadership of our veterans and will continue to provide them with the support and resources they deserve.”

“We are proud to stand with Bronx Borough President Vanessa Gibson at Sam H. Young American Legion Post 620 to honor a tradition of service that runs through every block of the Bronx,” said New York City Department of Veterans’ Services Commissioner James Hendon. “As we mark Veterans and Military Families Month, we recommit to practical, life-improving work — one claim, one home, one career at a time.”

“Veterans Appreciation Month is a way for us as a community to honor the men and women who served and are still serving our country,” said Commander Bobby Oviedo of the Sam H. Young American Legion Post 620. “We will never forget the sacrifices they and their families make to keep us all safe. For God and Country.”

The Bronx Borough President’s Office will continue to connect veterans and their families to resources and opportunities throughout the borough. The Bronx Veterans Resource Center at Bronx Borough Hall is open every Tuesday from 10:00 AM to 4:00 PM, providing veterans and their families with access to a wide range of services. For more information about the Veterans Resource Center, veterans are encouraged to contact the NYC Department of Veterans’ Services at 212-416-5250, email them at connect@veterans.nyc.gov or make an appointment at nyc.gov/vetconnect.

Veterans Appreciation Month in New York City officially starts on Saturday, November 1st.

33 COMPANIES RECEIVE NEW YORK STATE SERVICE-DISABLED VETERAN-OWNED BUSINESS CERTIFICATION

Commissioner Jeanette Moy today announced that the following 33 businesses were recently certified by the New York State Office of General Services (OGS) Division of Service-Disabled Veterans’ Business Development.

The newly certified Service-Disabled Veteran-Owned Businesses (SDVOBs) are:

- ARP Group, located in Arverne, N.Y., provides computer-related services, temporary help services, and human resources consulting.

- Celebrities Quality Construction, located in the Bronx, N.Y., is a commercial painting contractor.

- Bravia Services, located in New York City, specializes in construction management, facilities management, safety compliance, procurement services, and staffing solutions.

- Haywood Remarketing, located in Walton, N.Y., manufactures dried and dehydrated food.

- Lyons and Sons Operations, located in Catskill, N.Y., is a container storage rental company.

- SempreFit Innovations, located on Staten Island, N.Y., specializes in the research and development of cell therapy solutions.

- Dabi Security Group, located in Middleton, N.Y., provides security and investigation services.

- SVT Solutions, located in Harker Heights, Texas, specializes in computer related services.

- Ctgroup Environmental, located in Annapolis, Md., is a safety oversight, auditing, and compliance company.

- Veterans Construction Group, located in Passaic, N.J., specializes in commercial and institutional building construction.

- The Cannabis Reserve, located in Scarsdale, N.Y., is a cannabis dispensary.

- Sterling Distribution, located in Miller Place, N.Y., is a building material dealer.

- Gateway International 360, located in Bear, Del., specializes in EV charging stations.

- CM Property Group, located in Liverpool, N.Y., is a residential and commercial building construction company.

- Fia Freight, located in Brooklyn, N.Y., specializes in general freight trucking.

- TLS Solutions, located in Brooklyn, N.Y., is a multifunctional administrative provider of real estate, supply procurement, and technology services.

- Angel HVAC-R and Electric, located in Floral Park, N.Y., services, installs and troubleshoots, heating, ventilation, and air-conditioning systems.

- BARC Safety, located in Sahuarita, Ariz., is a safety and security consultant.

- Bent Ear Solutions, located in Alexandria, Va., provides consulting services for technical design, development, and implementation of technical solutions.

- Inspired Solutions, located in Manassas, Va., provides value-added reseller, procurement, and supply chain and logistics services.

- Stragint, located in Clifton Park, N.Y., is a management consulting company offering assistance with cybersecurity, and cyber risk planning, analysis, assessment, and training.

- Aerospect, located in Brooklyn, Ala., specializes in geophysical surveying and mapping services.

- Wetherell Engineering, located in Oceanside, N.Y., provides engineering services to the transportation construction industry.

- Continuity Operations Group, located in Albany, N.Y., is a homeland security and disaster response and recovery company.

- Pazmino Construction, located in Cohoes, N.Y., is a site preparation contractor.

- William Graham Woodworks, located in Sherburne, N.Y., specializes in commercial and residential wood restoration, installation, and repair.

- 6G Ventures, located in Valatie, N.Y., sells construction and building materials, construction equipment, landscaping equipment and services, office supplies, and vehicles.

- Masi Sand and Gravel, located in Westmoreland, N.Y., is a poured concrete foundation and structure contractor.

- Triton Light Medical, located in Chesterfield, Va., is a medical, dental, and hospital equipment and supplies merchant wholesaler.

- Riteway Sprinkler, located in Bohemia, N.Y., installs fire suppression systems.

- Patriot Supply Unlimited, located in Roseville, Calif., provides management and logistic consulting services.

- MDCAPMD, located in Penfield, N.Y., specializes in cannabis crop farming.

- Trigen Services, located in Buffalo, N.Y., is a residential remodeling and site preparation contractor.

The OGS Division of Service-Disabled Veterans’ Business Development was created in May 2014 through the enactment of the Service-Disabled Veteran-Owned Business Act. There are 1,330 certified businesses.

The Act promotes and encourages the participation of Service-Disabled Veteran-Owned Businesses in NYS public procurements of public works, commodities, services, and technology to foster and advance economic development in the state. A directory of New York State-Certified Service-Disabled Veteran-Owned Businesses and more information about the program and the certification process can be found at ogs.ny.gov/Veterans/.

CONSUMER ALERT: The New York Department of State’s Division of Consumer Protection Warns Military Community to be Aware of Scams Targeting Service Members

July is Military Consumer Protection Month

Follow the New York Department of State on Facebook, X and Instagram for “Tuesday’s Tips” – Practical Tips to Educate and Empower New York Consumers on a Variety of Topics

Secretary Mosley: “With the number of scams targeting service members on the rise, it’s important for members of the military community to take the proper precautions to protect their personal information and finances before, during and after deployment.”

In recognition of Military Consumer Protection Month, the Department of State’s Division of Consumer Protection is warning members of the military community to be aware of scams targeting service members. Scams are surging nationwide, and members of the military community are frequent targets of scammers. According to the Federal Trade Commission, fraud cost veterans, service members and their families $477 million in 2023, and there were a total of 93,735 fraud reports within the community during that time. Imposter scams, online shopping scams and investment-related scams were the top three types of scams targeted at military members, veterans and their families.

“Many service members are young, live away from home and are managing their own finances for the first time, making them attractive targets for opportunistic scammers,” said Secretary of State Walter T. Mosley. “With the number of scams targeting service members on the rise, it’s important for members of the military community to take the proper precautions to protect their personal information and finances before, during and after deployment.”

The Division of Consumer Protection recommends the following scam precautions for active-duty service members to help identify when something isn’t right and help ensure they are prepared to protect their personal information, accounts, identity and money from fraudulent practices.

TIP #1: PREVENT IDENTITY THEFT BY USING AN “ACTIVE-DUTY ALERT”

The Federal Trade Commission (FTC) reports that active-duty service members file reports of identity theft at much higher rates than non-military consumers. If you are called to active duty, put an “Active-Duty Alert” on your credit report to minimize your risk for identity theft. Benefits include:

- Businesses must verify identity before issuing new credit.

- Lasts one year but is renewable.

- Removes names from marketing lists for unsolicited credit and insurance offers for two years.

To add an Active-Duty Alert on your credit report, contact any one of the three main credit reporting agencies here: https://www.identitytheft.gov/

Don’t fall for credit monitoring scams: These scams target active-duty members who are being deployed. They offer to monitor credit and defend against identity theft, but instead they use the victim’s credit information to go on a spending spree, leaving the victim to foot the bill. An Active-Duty Alert on your credit report is the safer way to protect your credit.

TIP #2: PROTECT YOUR PURCHASES AND INVESTMENTS

No matter where you shop, do your research first. It’s important to search online for credible opinions from trusted sources and compare reviews from a variety of websites.

Know what to look for when buying or selling a vehicle:

A vehicle is one of the most expensive purchases you will make. If you are buying or selling a vehicle, below are a few red flags to look for:

- Be skeptical of so-called “military friendly” sellers: Scammers often do this to get you to let down your guard. Be wary of anyone that is offering an “incredible deal,” sometimes claiming to be the family of a service member who was recently deployed or died in combat. In both situations, the scammer is using service member affinity to discourage you from looking too closely at the deal or negotiating in good faith.

- Be cautious of fake websites or fake listings: These fake websites often post ads that offer discounts for military personnel but charge upfront fees that require a wire transfer. Scammers often list vehicles for sale on online marketplaces like eBay, Facebook and Craigslist. The scammers collect a deposit but never deliver the vehicle.

- If you’re buying: Research the vehicle and its cost. Some dealers try to overcharge service members, offer unfavorable terms or add on expensive optional products, like paint protection, service contracts or Guaranteed Asset Protection (GAP) insurance. Don’t act on impulse or pressure. Salespeople will often want you to buy the car immediately, but you should take the time to research the price and check out the car carefully, including getting a used vehicle history report.

- If you are selling or trading in a vehicle, use a resource like Kelley Blue Book, Edmunds or the National Automobile Dealers Association’s Guides to determine how much your current car is worth.

- If financing, do extensive research to understand your options. Be wary of “instant approval” military loans (“no credit check,” “all ranks approved”) that can have high interest rates and hidden fees.

Learn to identify fake rental properties:

Scammers will often steal a photo from the internet to create a fake rental listing in an effort to steal your deposits or the private information on your rental application. Often, these scams target military personnel looking for housing near a base or will offer military discounts. Be cautious of listings that are advertising an unusually low rent or are much nicer than other properties at that price point. Make sure to pay any application fees or deposits by check or credit card. If you are required to pay a fee via wire transfer or money transfer app to see the property, this is a red flag that the listing may be fake.

TIP #3: KNOW WHO YOU ARE DEALING WITH

- Imposter scam artists will often portray themselves as someone they are not to trick you into giving them your personal information or money. They may pose as a friend on social media, a romantic interest on a dating app or a fellow service member to gain your trust. If anyone reaches out to you over social media, email, phone, text or dating apps and asks for money or financial information, ignore them and report the fraud. Never provide personal or financial information to someone if you did not initiate contact with them. These are often attempts to steal your identity and gain access to your money.

- If a debt collector contacts you and you don’t recognize the company or the debt, first request information including the collector’s or company’s name, the company’s street address, telephone number, license number (if you’re in a municipality that requires one, such as New York City or Buffalo) and validation of the debt to ensure the debt collector and the debt are both legitimate. Unscrupulous debt collectors will often insist you owe a debt even if you don’t.

- Be wary if you are asked to pay in an unusual manner, such as a money transfer app or by using a reloadable gift card. These methods are untraceable and it’s nearly impossible to get your money back.

- Be suspicious of anyone who communicates exclusively through social media, messaging apps or email. Be especially wary of those who refuse to give you alternate methods to contact them.

- Watch out for impersonators that pretend to be from Defense Finance and Accounting Services or another military group. They will contact members or their spouses by phone, email or text. They may claim that due to computer problems, your information was lost and needs to be reentered to process payments. In other cases, their emails contain links or attachments that can put malware on computers to steal passwords and account information. DFAS and other military organizations generally do not ask for personal financial information, account numbers or passwords.

- As a general rule, service members and their families should never give personal information by phone or by clicking on links in emails to an unknown company or person. When in doubt, disengage from communication until you have had time to research the company or person to make sure they are legitimate.

CONSUMER ALERT: The New York Department of State’s Division of Consumer Protection Warns Military Community to be Aware of Scams Targeting Service Members

July is Military Consumer Protection Month

Follow the New York Department of State on Facebook, X and Instagram for “Tuesday’s Tips” – Practical Tips to Educate and Empower New York Consumers on a Variety of Topics

Secretary Mosley: “With the number of scams targeting service members on the rise, it’s important for members of the military community to take the proper precautions to protect their personal information and finances before, during and after deployment.”

In recognition of Military Consumer Protection Month, the Department of State’s Division of Consumer Protection is warning members of the military community to be aware of scams targeting service members. Scams are surging nationwide, and members of the military community are frequent targets of scammers. According to the Federal Trade Commission, fraud cost veterans, service members and their families $477 million in 2023, and there were a total of 93,735 fraud reports within the community during that time. Imposter scams, online shopping scams and investment-related scams were the top three types of scams targeted at military members, veterans and their families.

“Many service members are young, live away from home and are managing their own finances for the first time, making them attractive targets for opportunistic scammers,” said Secretary of State Walter T. Mosley. “With the number of scams targeting service members on the rise, it’s important for members of the military community to take the proper precautions to protect their personal information and finances before, during and after deployment.”

The Division of Consumer Protection recommends the following scam precautions for active-duty service members to help identify when something isn’t right and help ensure they are prepared to protect their personal information, accounts, identity and money from fraudulent practices.

TIP #1: PREVENT IDENTITY THEFT BY USING AN “ACTIVE-DUTY ALERT”

The Federal Trade Commission (FTC) reports that active-duty service members file reports of identity theft at much higher rates than non-military consumers. If you are called to active duty, put an “Active-Duty Alert” on your credit report to minimize your risk for identity theft. Benefits include:

- Businesses must verify identity before issuing new credit.

- Lasts one year but is renewable.

- Removes names from marketing lists for unsolicited credit and insurance offers for two years.

To add an Active-Duty Alert on your credit report, contact any one of the three main credit reporting agencies here: https://www.identitytheft.gov/

Don’t fall for credit monitoring scams: These scams target active-duty members who are being deployed. They offer to monitor credit and defend against identity theft, but instead they use the victim’s credit information to go on a spending spree, leaving the victim to foot the bill. An Active-Duty Alert on your credit report is the safer way to protect your credit.

TIP #2: PROTECT YOUR PURCHASES AND INVESTMENTS

No matter where you shop, do your research first. It’s important to search online for credible opinions from trusted sources and compare reviews from a variety of websites.

Know what to look for when buying or selling a vehicle:

A vehicle is one of the most expensive purchases you will make. If you are buying or selling a vehicle, below are a few red flags to look for:

- Be skeptical of so-called “military friendly” sellers: Scammers often do this to get you to let down your guard. Be wary of anyone that is offering an “incredible deal,” sometimes claiming to be the family of a service member who was recently deployed or died in combat. In both situations, the scammer is using service member affinity to discourage you from looking too closely at the deal or negotiating in good faith.

- Be cautious of fake websites or fake listings: These fake websites often post ads that offer discounts for military personnel but charge upfront fees that require a wire transfer. Scammers often list vehicles for sale on online marketplaces like eBay, Facebook and Craigslist. The scammers collect a deposit but never deliver the vehicle.

- If you’re buying: Research the vehicle and its cost. Some dealers try to overcharge service members, offer unfavorable terms or add on expensive optional products, like paint protection, service contracts or Guaranteed Asset Protection (GAP) insurance. Don’t act on impulse or pressure. Salespeople will often want you to buy the car immediately, but you should take the time to research the price and check out the car carefully, including getting a used vehicle history report.

- If you are selling or trading in a vehicle, use a resource like Kelley Blue Book, Edmunds or the National Automobile Dealers Association’s Guides to determine how much your current car is worth.

- If financing, do extensive research to understand your options. Be wary of “instant approval” military loans (“no credit check,” “all ranks approved”) that can have high interest rates and hidden fees.

Learn to identify fake rental properties:

Scammers will often steal a photo from the internet to create a fake rental listing in an effort to steal your deposits or the private information on your rental application. Often, these scams target military personnel looking for housing near a base or will offer military discounts. Be cautious of listings that are advertising an unusually low rent or are much nicer than other properties at that price point. Make sure to pay any application fees or deposits by check or credit card. If you are required to pay a fee via wire transfer or money transfer app to see the property, this is a red flag that the listing may be fake.

TIP #3: KNOW WHO YOU ARE DEALING WITH

- Imposter scam artists will often portray themselves as someone they are not to trick you into giving them your personal information or money. They may pose as a friend on social media, a romantic interest on a dating app or a fellow service member to gain your trust. If anyone reaches out to you over social media, email, phone, text or dating apps and asks for money or financial information, ignore them and report the fraud. Never provide personal or financial information to someone if you did not initiate contact with them. These are often attempts to steal your identity and gain access to your money.

- If a debt collector contacts you and you don’t recognize the company or the debt, first request information including the collector’s or company’s name, the company’s street address, telephone number, license number (if you’re in a municipality that requires one, such as New York City or Buffalo) and validation of the debt to ensure the debt collector and the debt are both legitimate. Unscrupulous debt collectors will often insist you owe a debt even if you don’t.

- Be wary if you are asked to pay in an unusual manner, such as a money transfer app or by using a reloadable gift card. These methods are untraceable and it’s nearly impossible to get your money back.

- Be suspicious of anyone who communicates exclusively through social media, messaging apps or email. Be especially wary of those who refuse to give you alternate methods to contact them.

- Watch out for impersonators that pretend to be from Defense Finance and Accounting Services or another military group. They will contact members or their spouses by phone, email or text. They may claim that due to computer problems, your information was lost and needs to be reentered to process payments. In other cases, their emails contain links or attachments that can put malware on computers to steal passwords and account information. DFAS and other military organizations generally do not ask for personal financial information, account numbers or passwords.

- As a general rule, service members and their families should never give personal information by phone or by clicking on links in emails to an unknown company or person. When in doubt, disengage from communication until you have had time to research the company or person to make sure they are legitimate.

About the New York State Division of Consumer Protection

Follow the New York Department of State on Facebook, X and Instagram

The New York State Division of Consumer Protection provides voluntary mediation between a consumer and a business when a consumer has been unsuccessful at reaching a resolution on their own. The Consumer Assistance Helpline 1-800-697-1220 is available Monday to Friday from 8:30am to 4:30pm, excluding State Holidays, and consumer complaints can be filed at any time at www.dos.ny.gov/

The Black Soul Music Experience Podcast

The Black Soul Music Experience Podcast where i do the history of Black Music by bringing in special guests from all generes of Black Music: musicians and those who were musicians, former radio d.j. personalities, d.j’s who does gigs, music historians, and those who once worked for music record companies. It’s on every Tuesdays available on Apple, Spotify/Riverside,

New Yorkers with Disabilities

You can access resources for New Yorkers with disabilities, including mental health support, food resources, transportation, utilities, housing and more from the NYC Mayor’s Office for People with Disabilities COVID-19 resource page here. You may also contact my office at 212-828-5829 or at serrano@nysenate.gov.

59 COMPANIES RECEIVE NEW YORK STATE SERVICE-DISABLED VETERAN-OWNED BUSINESS CERTIFICATION

Commissioner Jeanette Moy today announced that the following 59 businesses were recently certified by the New York State Office of General Services (OGS) Division of Service-Disabled Veterans’ Business Development.

The newly certified Service-Disabled Veteran-Owned Businesses (SDVOBs) are:

- Green Veteran NY, located in Albany, N.Y., is an adult-use retail dispensary.

- Cabiria Films, located in New York City, specializes in motion picture and video production.

- Apex Technical Solutions, located in Holland, N.Y., provides technical services and solutions to manufacturers.

- Battleship Construction, located in Howard Beach, N.Y., is a poured concrete foundation and structure contractor.

- Raven EUS, located in Glen Cove, N.Y., provides handyman and landscaping services.

- Dynamic Consulting and Management Group, located in Uniondale, N.Y., provides construction management services.

- Urban Coyote, located in Middletown, N.Y., specializes in waterfront marine, aerial, and surveying engineering.

- Alliance Innovations, located in San Diego, Calif., specializes in programming software, website development, and management.

- Primestone Consulting, located in New York City, provides professional, scientific, and technical construction services.

- CFF Consulting, located in Mineola, N.Y., is a residential and nonresidential property management, masonry, and roofing contractor.

- Greater Frontier, located in Buffalo, N.Y., specializes in construction estimation and project management.

- Defense Consulting Services, located in San Antonio, Texas, provides administrative management and general management consulting services.

- Capital Digitronics, located in Albany, N.Y., sells and services two-way radio and microwave communications components and systems.

- Frontier Point Logistics, located in Rockville Centre, N.Y., specializes in consulting and IT staffing solutions.

- Lifeline Energy Solutions, located in the Bronx, N.Y., repairs and maintains commercial and industrial machinery and equipment.

- Bestos Home Services, located in Comstock, N.Y., specializes in environmental consulting services.

- Anthony J. Felli DDS P.C., located in Geneva, N.Y., is a dental office.

- Asset Packaging Management, located in Saratoga Springs, N.Y., is a cannabis wholesaler.

- MAC62 Holdings, located in Selden, N.Y., is a cannabis retailer.

- Fast K. Consulting, located in Brooklyn, N.Y., provides administrative management and general management consulting services.

- Wise Components, located in Stamford, Conn., distributes OEM parts, systems, and supplies.

- Oasis Cannabis, located in Middleport, N.Y., specializes in cannabis cultivation.

- SubVet Supply, located in Greenfield, N.Y., is an industrial supplies merchant wholesaler.

- TDK Consulting, located in Lorton, Va., specializes in health system management and planning.

- Bronson Construction Group, located in Canandaigua, N.Y., constructs new multifamily housing.

- Armedia, located in Vienna, Va., provides IT and document management services.

- VDO Gaming & eSports Education, located in Cohoes, N.Y., runs educational programs designed for gamers and eSports enthusiasts.

- Arthur Engineering, located in Rochester, N.Y., specializes in environmental engineering and consulting services.

- DoloTek, located in Camillus, N.Y., is a manufacturer and distributor of LED lighting solutions.

- Haven Group, located in Melbourne Beach, Fla., is a management consulting firm.

- Rise Again Engineering, located in Scotia, N.Y., specializes in civil and environmental engineering, asbestos inspection, and asbestos project design.

- The Hoag Group, located in Buffalo, N.Y., specializes in residential and commercial general construction and landscaping.

- SDV Office Systems, located in Fletcher, N.C., is a management consulting company.

- ZRB Welding, located in Cobleskill, N.Y., provides welding and mechanical services.

- Matterhorn Advisors, located in Charlotte, N.C., is a management consulting services company.

- MSG Consulting Group, located in Albany, N.Y., provides energy, construction management, and real estate consulting services.

- David Cruz Engineering, located in Bethel, Conn., is an engineering consulting firm.

- EJS Great Lakes Dive Solutions, located in Lewiston, N.Y., is a specialized diving and underwater services company.

- Ej Brown Courier Service, located in West Babylon, N.Y., is a courier for the medical industry.

- Office Design & Furnishings, located in Albany, N.Y., is a contract furniture dealer.

- Elite Excavation, located in Hamburg, N.Y., specializes in commercial and residential excavation and general contracting.

- ALC Builders, located in Dobbs Ferry, N.Y., provide all services regarding structural concrete and masonry.

- Vanguard Innovative Solutions, located in East Amherst, N.Y., specializes in Computer systems design services.

- VCI, located in Covington, La., designs and manages construction projects from initial concept through commissioning and activation.

- Insight Ops Cost & Schedule Consulting, located in Rochester, N.Y., offers a comprehensive range of services to ensure construction projects stay on track and within budget.

- Synensys, located in Peachtree City, Ga., provides safety management and consulting services.

- Underground Transmission Solutions, located in Fort Lee, N.J., specializes in consulting, temporary project management services, and business-to-business sales.

- Spadafarm, located in Lagrangeville, N.Y., is a cannabis cultivator.

- Sphinx Construction Logistics, located in Machias, N.Y., provides support to general contractors in commercial and residential construction.

- The Flowery, located on Staten Island, N.Y., is a retail cannabis company.

- Willie Joe Lightfoot Sr., located in Rochester, N.Y., provides dry cleaning and laundry services.

- Transition Capital, located in Rochester, N.Y., specializes in miscellaneous intermediation.

- Lit Technologies, located in Midlothian, Va., provides IT and non-IT contingent staffing services.

- Second Service Partners, located in Linden, Texas, specializes in healthcare project management and clinical transition and activation planning.

- Whyte Contracting, located in Copiague, N.Y., is a construction services company serving residential and commercial clients.

- Veteran Crew Concepts, located in Blue Bell, Pa., specializes in security and safety services.

- Retire LE Consultants, located in Logan, Utah, provides active threat training and equipment.

- Crestview IPS, located in Greenville, S.C., specializes in construction services.

- Patriot Construction Enterprise, located in Boston, N.Y., is a general construction, construction management, and construction site representative company.

The OGS Division of Service-Disabled Veterans’ Business Development was created in May 2014 through the enactment of the Service-Disabled Veteran-Owned Business Act. There are 1,388 certified businesses.

The Act promotes and encourages the participation of Service-Disabled Veteran-Owned Businesses in NYS public procurements of public works, commodities, services, and technology to foster and advance economic development in the state. A directory of New York State-Certified Service-Disabled Veteran-Owned Businesses and more information about the program and the certification process can be found at ogs.ny.gov/Veterans/.

26 COMPANIES RECEIVE NEW YORK STATE SERVICE-DISABLED VETERAN-OWNED BUSINESS CERTIFICATION

Commissioner Jeanette Moy today announced that the following 26 businesses were recently certified by the New York State Office of General Services (OGS) Division of Service-Disabled Veterans’ Business Development.

The newly certified Service-Disabled Veteran-Owned Businesses (SDVOBs) are:

M&T Advanced Building Solutions, located in Accord, N.Y., specializes in commercial and residential construction.

Klein & Associates, located in Rancho Palos, Calif., provides temporary help services.

GD Resources, located in Gaithersburg, Md., is an IT and professional services company.

Liberty Construction Enterprise, located in Eastport, N.Y., specializes in commercial and residential construction, excavation, and site work.

Vespa Group, located in Indianapolis, Ind., is a technology consulting and staffing firm.

La Gente Consulting, located in San Antonio, Texas, specializes in healthcare strategy, operations, and data analytics.

Telecommunication Electrical Contractors, located in Woodside, N.Y., is an electrical contractor focusing on commercial, residential, and industrial projects.

Y.D.E. Properties and Property Management, located in Memphis, N.Y. buys, sells, and manages real estate property.

VUCA Consulting, located in New York City, is a consulting and staffing solutions company focusing primarily on the entry-level workforce.

Lamonica’s Naturals, located in Bohemia, N.Y., is a skincare brand under THETRENDHIVE, specializing in natural, organic, and tallow-based skincare products for men and women.

A Aye Aye, located in Tonawanda, N.Y., provides professional software solutions, specializing in AI governance, compliance automation, and risk management framework support federal, defense, and enterprise clients.

Burke Electric, located in Menands, N.Y., is a commercial electrical contractor.

Set 4 Life Lawncare Services, located in Boulder, Colo, provides landscaping services.

Brehove Management Consulting, located in Hoboken, N.J., specializes in administrative management and general management consulting services.

Signature Labor Services, located in Knoxville, Tenn., provides skilled trade labor staffing solutions.

Bastion Contracting, located in Chappaqua, N.Y., is a commercial and institutional building construction and property management company.

Persistent Technology, located in Alexandria, Va., is a custom computer programming services firm.

Response Heart Recovery, located in New York City, specializes in CPR and first aid training.

CNY Trimlight, located in Oneonta, N.Y., is an electrical and other wiring installation contractor.

Semper Corp, located in Yonkers, N.Y., is a construction consulting and materials company.

Intuitial, located in Encinitas, Calif., provides computer systems design services.

Mario Power Generator Service, located in Roselle Park, N.J., is a commercial and industrial machinery and equipment repair and maintenance company.

Haselton Lumber Products, located in Wilmington, N.Y., specializes in custom architectural woodwork and millwork manufacturing.

Upstate Edge, located in Albany, N.Y., is a cannabis dispensary.

Calvary Transport Services, located in Rosedale, N.Y., provides limousine service.

Grobiotics, located in Saranac Lake, N.Y., is a cannabis micro dispensary.

The OGS Division of Service-Disabled Veterans’ Business Development was created in May 2014 through the enactment of the Service-Disabled Veteran-Owned Business Act. There are 1,382 certified businesses.

The Act promotes and encourages the participation of Service-Disabled Veteran-Owned Businesses in NYS public procurements of public works, commodities, services, and technology to foster and advance economic development in the state. A directory of New York State-Certified Service-Disabled Veteran-Owned Businesses and more information about the program and the certification process can be found at ogs.ny.gov/Veterans/.

Ask Rusty -- Older Veteran Asks about Special Social Security Credit for Military Service

Dear Rusty: I served in the U S Army from January 1958 to Feb 1961. What increase should I receive for those years and who do I call and at what phone number? Signed: Proud Veteran

Dear Proud Veteran: First, thank you for your military service! I expect you are referring to the “special extra credits for military service” which are available to some who served in in the US Military in earlier years. It is important to note that these “extra credits” take the form of an adjustment to your military pay record while serving and are not an incremental amount added to your monthly Social Security benefit because you served.

Military pay has been subject to deductions for Social Security since 1957. Thus, while serving between 1958 and 1961 you paid SS tax on your military earnings. But, for purposes of determining your Social Security benefit, your military earnings record would be increased by $300 for each quarter you served on active duty, up to a maximum of $1,200 increase per year of service. That means for 1958 – 1960, when calculating your SS benefit, $1,200 would be added to your military earnings record for each year you served. FYI, for those who served after 1967, this adjustment was automatically made by Social Security. But for service years prior to 1967 (as in your case) you would need to inform Social Security of your service when you claimed SS and provide a copy of your military form DD-214 (your discharge papers). SS would then make the appropriate adjustment to your military earnings record prior to calculating your benefit amount. And, for clarity, additional credits for military service are not available to those who served after 2001.

A key point to understand is that this adjustment to your military pay may – or may not – affect the amount of your Social Security benefit. Social Security determines your benefit amount based on your highest earning 35 years over your entire lifetime (adjusted for inflation). If, after you served in the military, you had at least 35 years of civilian employment where you earned more than your military pay, it is probable that your military pay is not included when calculating your Social Security benefit. If that is the case, it is likely that the “special extra credits for military service” would have no effect on your Social Security payment. If, however, your military pay (including those special extra credits) for any year is more than you earned in civilian life, then you can contact Social Security (1.800.772.1213), provide them with a copy of your DD-214, and ask that they recalculate your Social Security benefit to include the extra credits for your years of military service.

JHP Secures NYC Discretionary Fund Renewal

In 2024 86 veterans participated in our veteran-specific work, and interest continues to grow as we expand our partnerships with Vet Centers, other VA sites, and community groups throughout the city.

Generous support for this project has been provided by the New York City Council’s Veterans Community Development Initiative through the Department of Youth and Community Development. We are proud to announce these funds have been renewed for FY25. This renewal is essential to hiring staff and continuing our popular classes.

Veterans are an important part of the JHP community, in fact, our veterans programs are the foundation of our nearly 80-year legacy. Josephine Herrick founded Volunteer Service Photographers to help World War II veterans re-acclimate and explore their voices after their service ended. Over the years the organization evolved and in 2014 we were renamed in her honor.

We are always thankful to have the opportunity and funding to continue Josephine Herrick’s original passion of supporting veterans through photography.

Veteran Uncertain About Social Security and Healthcare Coverage

Dear Rusty: I’m not sure what I should sign up for in terms of Social Security: I am 64 and I am still employed full time and intend to stay employed until age 70. I am retired from the Navy and receive military retirement payments, and have military TriCare, as well as medical, dental, eye and life insurance through my employer. I don’t want to lose benefits, but I also don’t want to take Social Security until it reaches the maximum at age 70 (I think that is correct?). I will turn 65 in 4 months. Can you advise me? Signed: Uncertain Veteran

Dear Uncertain Veteran: First of all, thank you for your service to our country. From what you’ve shared, and since you’re still working full time, not claiming Social Security yet is a smart decision. If you were born in 1959 your full retirement age (FRA) is 66 years and 10 months and, if you claim SS before your full retirement age, you’ll be subject to Social Security’s earning test which would likely make you ineligible to receive SS benefits at this time.

The 2024 earnings limit (limit changes yearly) when collecting Social Security early is $22,320 and, if that is exceeded, Social Security will take away $1 in benefits for every $2 over the limit (half of what you exceed the limit by). If you significantly exceed the limit, SS will declare you temporarily ineligible to collect SS benefits until you either reach your FRA or earn less. The earnings test no longer applies after you reach your FRA. So, if you’re now employed full time and plan to stay so until age 70, and you expect at least average longevity (about 84 for someone your current age), delaying until age 70 to claim Social Security is how to get your maximum Social Security benefit.

As for your healthcare coverage as a veteran: TriCare requires you to enroll in Medicare Part A (inpatient hospitalization coverage) and Part B (coverage for outpatient services) at age 65, but you do not need to take Social Security when you enroll in Medicare. You must, however, enroll in Medicare at age 65 or you will lose your TriCare (military) healthcare coverage. You could choose to delay enrolling in Medicare at 65 because you have “creditable” employer coverage, but if you do so you will lose your current TriCare coverage and need to rely solely on your employer healthcare plan. In that case, you would still be able to enroll in both Medicare and TriCare-for-Life without penalty prior to your employer coverage ending and have coverage under both programs thereafter. I suggest you contact TriCare directly at 1-866-773-0404 to discuss your personal TriCare coverage after age 65. You can also go to www.TriCare4U.com.

Whenever you enroll, Medicare will be the primary payer of your healthcare costs and TriCare will be the secondary payor. Your vision, dental, and prescription drug coverage would be through TriCare (Medicare does not cover those services) or acquired separately. Just remember, you must be enrolled in Medicare Part A and Part B to have TriCare-for-Life coverage after age 65.

Bible Search Answers

The Wall That Heals is Headed to New York City!

The Wall That Heals is Headed to New York City!

This official replica of the Vietnam Veterans Memorial in Washington, D.C. will be visiting Flushing Meadows Corona Park in Queens from Sept 27 – Oct 1, 2023.

For more information visit the-wall-that-heals (nyc.gov)

If interested in volunteering visit The Wall That Heals – Volunteer Signup (formsite.com)

In Memory Program

The Vietnam Veterans Memorial Fund’s In Memory program honors those who returned home from Vietnam and later died.

To have a loved one considered for the In Memory program when The Wall That Heals visits New York City, you must submit your application to VVMF by August 28, 2023.

To apply online, www.vvmf.org/In-

If you have any questions please email: InMemory@vvmf.org or review the VVMF Frequently Asked Questions section.

Senate & Assembly Members Dems Announce Legislation Supporting Veterans

Albany, NY – On Tuesday, May 23rd at 12:00 PM, Senators Nathalia Fernandez, Jessica Scarcella-Spanton and Assemblymembers Harvey Epstein, Catalina Cruz will hold a press conference for 2 critical pieces of legislation designed to support and assist our nation’s veterans: S4515 and S3586. S4515 relates to adding veterans to protected classes for unlawful housing discrimination. S3586 Establishes the Alex R. Jimenez New York state military immigrant family legacy program.

MAYOR ADAMS REAPPOINTS JAMES HENDON AS COMMISSIONER OF NYC DEPARTMENT OF VETERANS’ SERVICES

NEW YORK – New York City Mayor Eric Adams today announced the reappointment of James Hendon as commissioner of the New York City Department of Veterans’ Services. Hendon will continue to lead the department to provide the city’s veterans with essential services and programs focused on pivotal areas, such as economic empowerment, housing security, benefits, health and wellness, and culture.

“James Hendon has devoted his career to serving our country and our city, and we are honored to have him continue to serve the tens of thousands of veterans living in New York City as commissioner of the Department of Veterans’ Services,” said Mayor Adams. “As a combat veteran and lieutenant colonel in the U.S. Army Reserve, James has illustrated a sincere commitment to ensuring his fellow veterans have access to services that are both impactful and compassionate. He has a proven track record of being an innovative leader, and I am proud to reappoint him to this role.”

“Commissioner Hendon is truly a tireless advocate for the city’s veterans and their families,” said Deputy Mayor for Health and Human Services Anne Williams-Isom. “As a combat veteran, he knows the courage required to serve, the strong bond between service members, and the support needed when returning home. The Department of Veterans’ Services plays a key role in helping service members in their transition to civilian life and is a resource throughout their life whenever they need it. I look forward to continuing to work with Commissioner Hendon in the coming months and years.”

“I am humbled and overjoyed to be given the opportunity to keep serving New York City’s military veterans and their families,” said Commissioner James Hendon. “Mayor Adams has a vision of making New York City a place where, rather than spend disproportionate amounts of time and resources pulling people out of the river downstream, we prevent them from falling into the river upstream in the first place. We at the Department of Veterans’ Services embrace the mayor’s vision as it applies to our veterans and their loved ones. We proudly channel the mayor’s passion, viewpoint, efficiency, and sense of urgency as we empower the city’s veteran community to reach new heights.”

“I am pleased with the reappointment of New York City Department of Veterans’ Services Commissioner Hendon,” said U.S. Senate Majority Leader Charles Schumer. “New York City’s veterans are well-served by his effective and accountable leadership, and I look forward to continuing to work with the commissioner to ensure that our veterans have access to high-quality resources.”

“I am pleased that the Adams administration recognizes the great contributions Commissioner James Hendon has made for veterans in New York City, said Charles B. Rangel, former congressman; statesman-in-residence, City College of New York. “I look forward to the mayor’s continued support for Commissioner Hendon and the New York City Department of Veterans‘ Services that has done so much for our city’s military veterans.”

“I am happy to hear that Mayor Adams has reappointed Commissioner Hendon,” said New York City Councilmember Bob Holden. “As chair of the City Council’s Committee on Veterans, I’ve worked with him over the last eight months, and he has been a strong advocate for our veterans. I look forward to continuing to fight along with him for our veterans‘ needs.”

“I want to wholeheartedly congratulate my partner in New York City, James Hendon, on his reappointment as the commissioner of the New York City Department of Veterans’ Services,” said New York State Division of Veterans’ Services Director Viviana DeCohen. “I look forward to continuing our work and shared mission of providing the best services and programs for New York’s veterans, service members, and their families together.”

“Congratulations, Commissioner Hendon,” said Wendy McClinton, chair, Veterans Advisory Board; and CEO, Black Veterans for Social Justice. “Remember, Forward Ever, Backwards Never! I look forward to our continued collaboration.”

“Commissioner Hendon has been a great partner to the VA,” said Bruce Tucker, interim medical center director, New York Harbor. “His leadership has brought a high degree of collaboration between the VA and New York City to connect veterans to care and services. I am looking forward to this continued partnership with the commissioner and Department of Veterans’ Services.”

“Commissioner Hendon and the New York City Department of Veterans’ Services have been amazing partners to the Bob Woodruff Foundation and its mission,” said Bob Woodruff, founder, Bob Woodruff Foundation. “We are thrilled to continue our collaborative efforts to support and serve New York City veterans under Commissioner Hendon’s visionary leadership.”

About James Hendon

James Hendon is the commissioner of the New York City Department of Veterans‘ Services. Previously, Hendon served as director of the New York University Veterans Future Lab, a small business incubator for practicing and aspiring entrepreneurs who are U.S. military veterans or veterans‘ spouses.

A veteran entrepreneur himself, Hendon is the founder and former CEO of the Energy Economic Development Corporation, an organization that provides green energy workforce development training throughout the New York City area. Previously, Hendon served as the COO for BlocPower, a U.S. Department of Energy-sponsored company that helps nonprofits, small businesses, and faith centers perform energy efficiency retrofits. He previously worked as an associate in the Real Estate Investment Banking Group at Deutsche Bank.

Before entering the civilian workforce, Hendon spent seven years in the U.S. Army as an active-duty infantry officer, where he deployed as a mortar platoon leader and battalion public affairs officer to Iraq, worked as an admissions officer for West Point, and served as the senior advisor to the Afghan Border Police in Afghanistan.

Hendon also served as a mayoral appointee on the New York City Veterans Advisory Board. He has volunteered as a longtime mentor for the Eagle Academy for Young Men in the Bronx. Hendon has participated in various fellowships, including the Council of Urban Professionals, the Truman National Security Project, the Environmental Leadership Program, and Presidential Leadership Scholars.

As a drilling U.S. Army reservist, Hendon, a Lieutenant Colonel, currently serves as the battalion commander for 1st Battalion, 411th Regiment, 4th Cavalry Brigade — a logistics support battalion.

Hendon is a graduate of West Point, the Harvard Kennedy School, and the Columbia Business School. He is also a graduate of the Earth Institute’s Program in Conservation and Environmental Sustainability.

Yesterday, Today, and Tomorrow: Serving Our Nation's Veterans

- Qualifies for unemployment or has experienced a reduction in household income, incurred significant costs, or experienced a financial hardship due to COVID-19

- Demonstrates a risk of experiencing homelessness or housing instability and

- Has a household income at or below 80 percent of the area median income.

- ERAP is not guaranteed and will be determined on a case-by-case basis.

Now more than ever, your support will help America’s veterans find victory.

As veterans face new challenges, support for their victories is more vital than ever before. By finding space for our new print PSAs, you’ll help remind people to keep space in their hearts for those who have sacrificed so much.

DAV (Disabled American Veterans) helps more than a million veterans every year to find the health care, employment, education, and financial benefits they’ve earned.

Each of our new print PSAs features a real story of a real veteran, who has found their personal victory with the help of DAV. With your support, more veterans will get the care and benefits they need.

We hope you’ll help get these powerful messages out to your readers. You’ll find the PSAs for immediate download at davpsa.org. Resizes are available upon request.

Thank you for your support. And thank you for helping America’s veterans.

Sincerely,

Rob Lewis

DAV National Director of Communications

If you have any questions, or would like custom sizes, please contact Pam Atkinson at psa@dav.org or 410-626-0805.